vermont income tax brackets

The states top income tax rate of 875 is one of the highest in the nation. We will update this page with a new version of the form for 2023 as soon as it is made available by the.

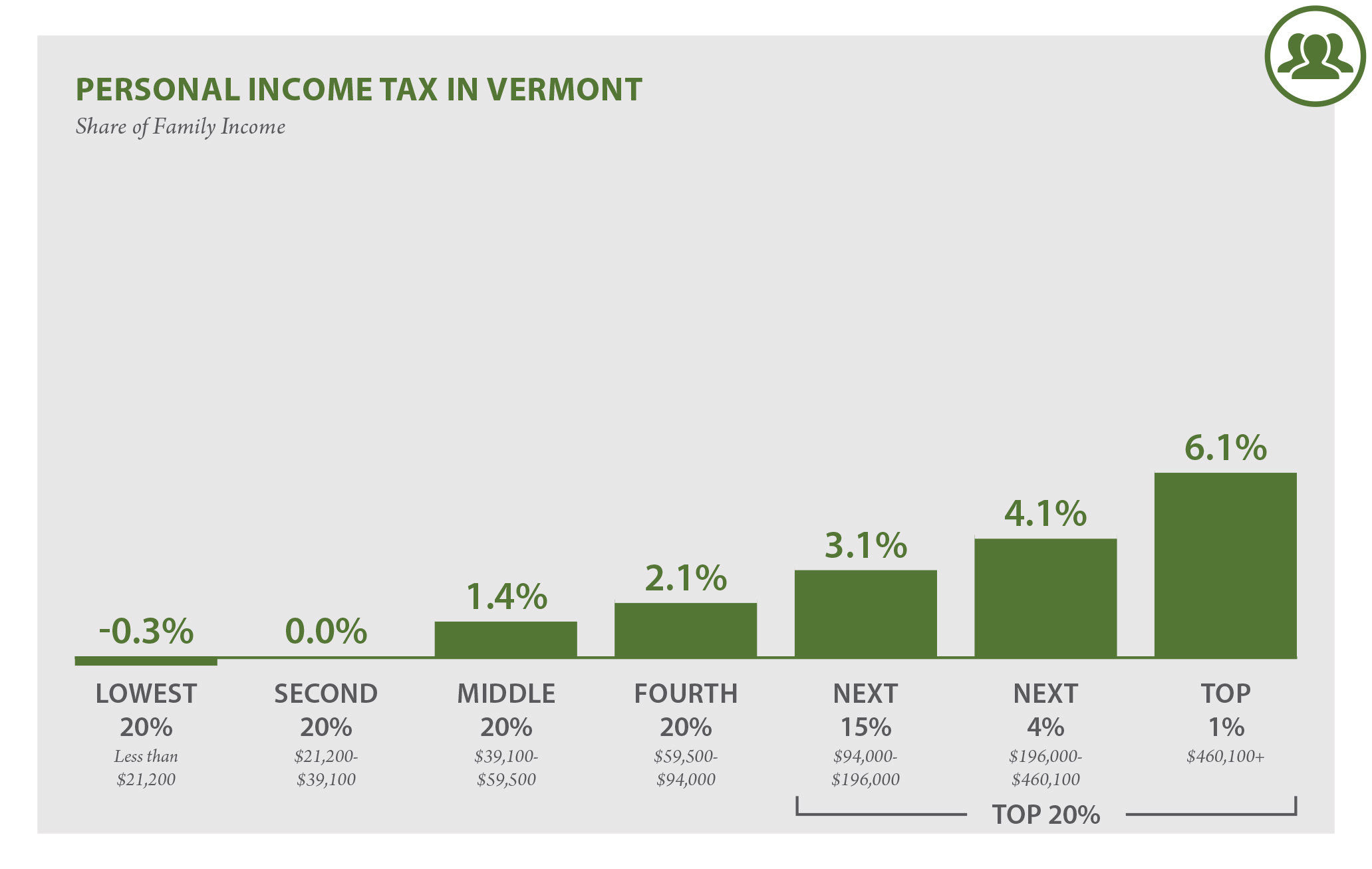

Vermont Who Pays 6th Edition Itep

No Vermont cities have local income.

. Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules. Income tax brackets are a helpful way to visualize your state and federal tax rate for the 2020 - 2021 filing season. Filing Status is Married Filing Jointly.

RateSched-2021pdf 3251 KB File Format. Vermonts income tax brackets were last changed two. 2020 VT Rate Schedules.

This page has the latest Vermont. This form is for income earned in tax year 2021 with tax returns due in April 2022. Tuesday January 25 2022 - 1200.

4 rows Vermonts 2022 income tax ranges from 335 to 875. We will update this page with a new version of the form for 2023 as soon as it is made available by the. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. For more information about the income tax in these states visit the Vermont and Connecticut income tax pages. 2020 VT Tax Tables.

The state income tax system in vermont is a progressive tax system. Compare your take home after tax and estimate. The Vermont Single filing status tax brackets are shown in the table below.

Vermont Tax Brackets for Tax Year 2020. Here is a list of current state tax rates. Property Tax Bill Overview.

Vermont Income Taxes. 2021 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000. 5 rows The Vermont Income Tax. Pay Estimated Income Tax Online.

Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000. Pay Estimated Income Tax by Voucher. 2022 INCOME TAX WITHHOLDING INSTRUCTIONS TABLES AND CHARTS State of Vermont Department of Taxes Taxpayer Services Division PO.

This tool compares the tax brackets for single individuals in each state. 2021 Income Tax Withholding Instructions Tables and Charts. Box 547 Montpelier VT 05601-0547.

2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Rates range from 335 to. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

Vermont has a graduated individual. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Vermont collects a state income tax at a maximum marginal tax.

Vermont has a progressive state income tax system with four brackets. Any income over 204000 and 248350 for. VT Taxable Income is 82000 Form IN-111 Line 7.

As you can see your Vermont income is taxed at different rates within the given tax brackets. Vermonts corporate income tax is a business tax levied on the. Vermont state income tax rate table for the 2020 - 2021.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. 2021 Vermont Income Tax Return Booklet. 4 rows Vermont Income Tax Rate 2020 - 2021.

Compare your take home after tax and estimate. This form is for income earned in tax year 2021 with tax returns due in April 2022.

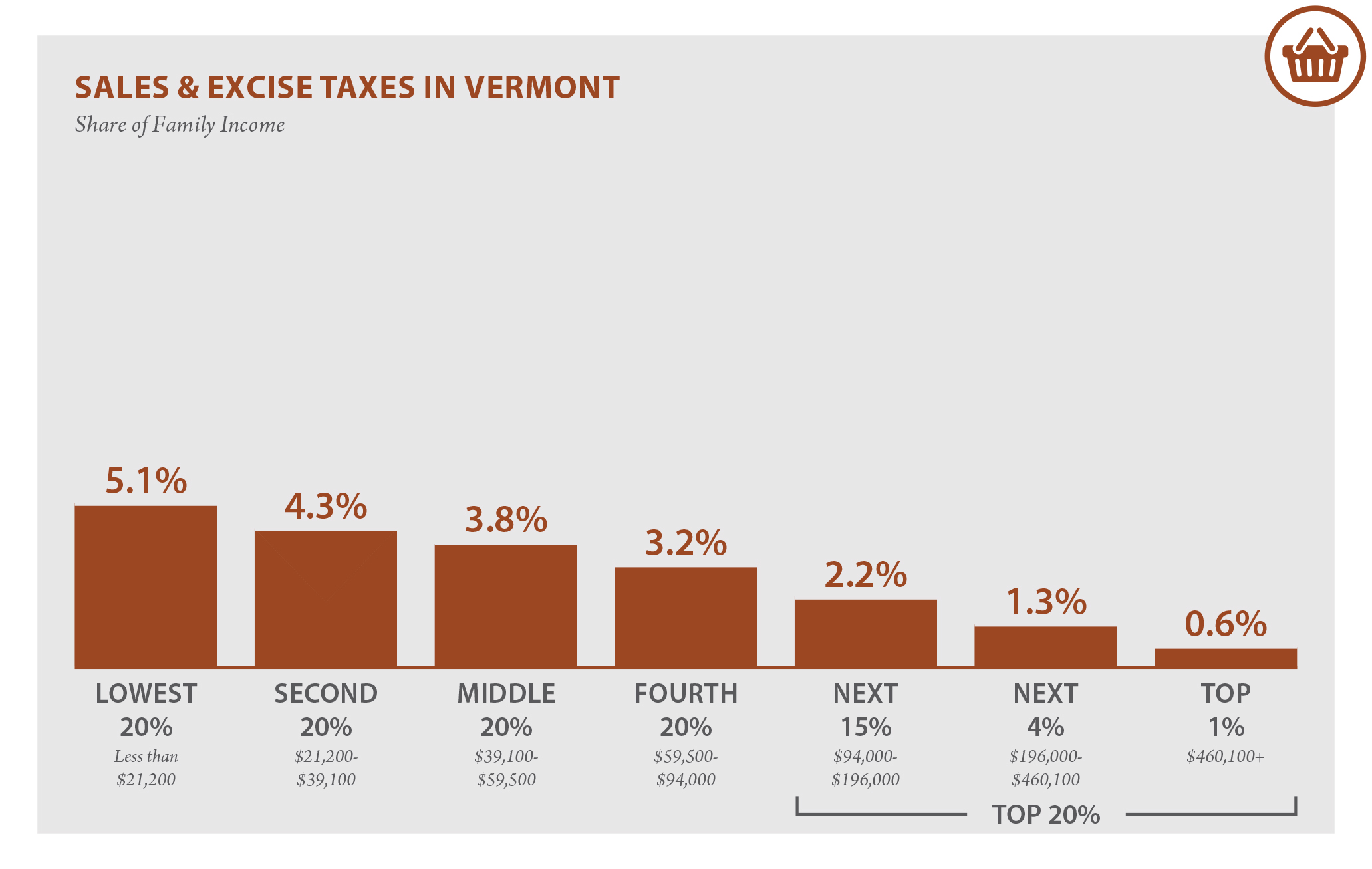

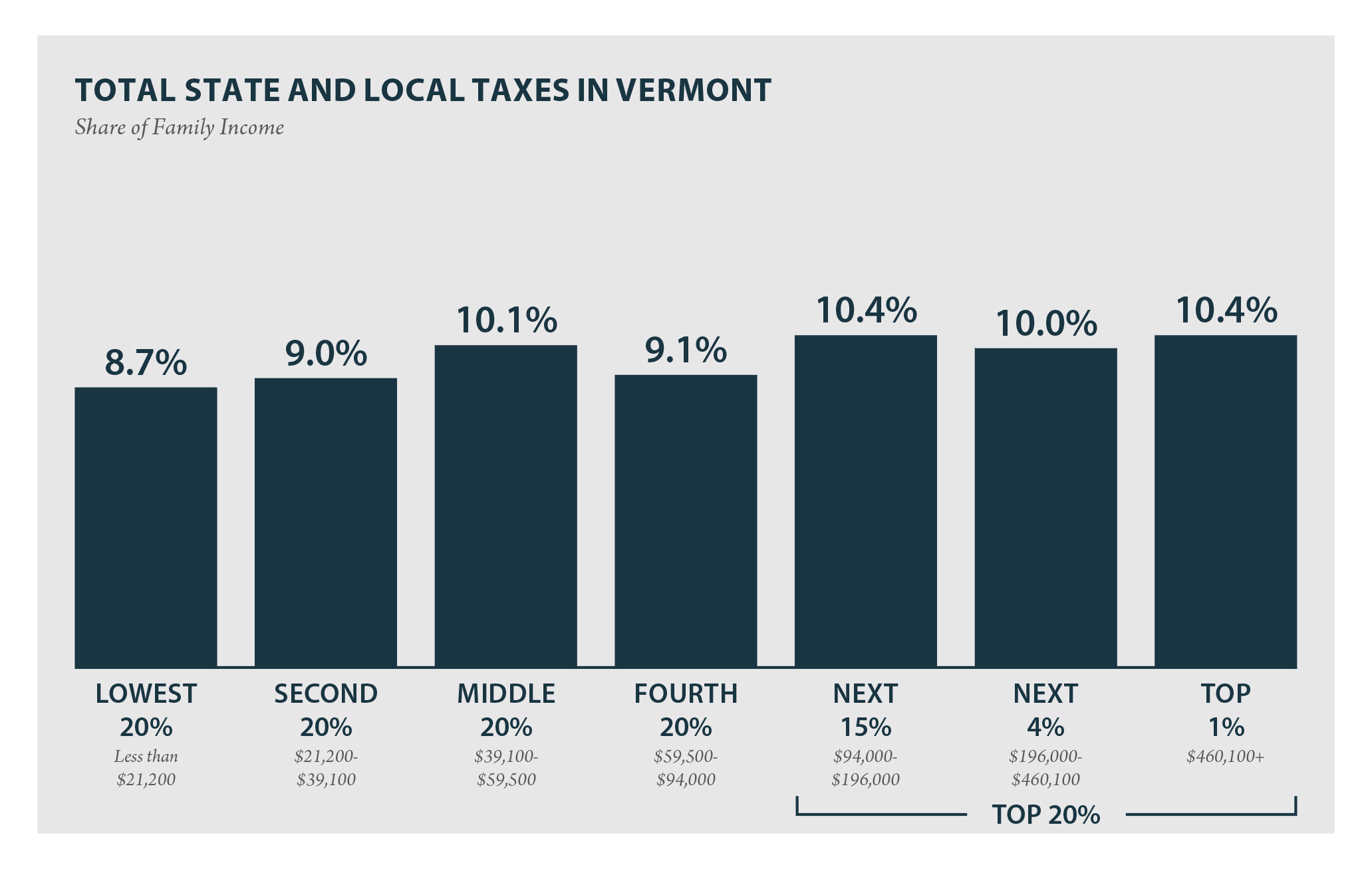

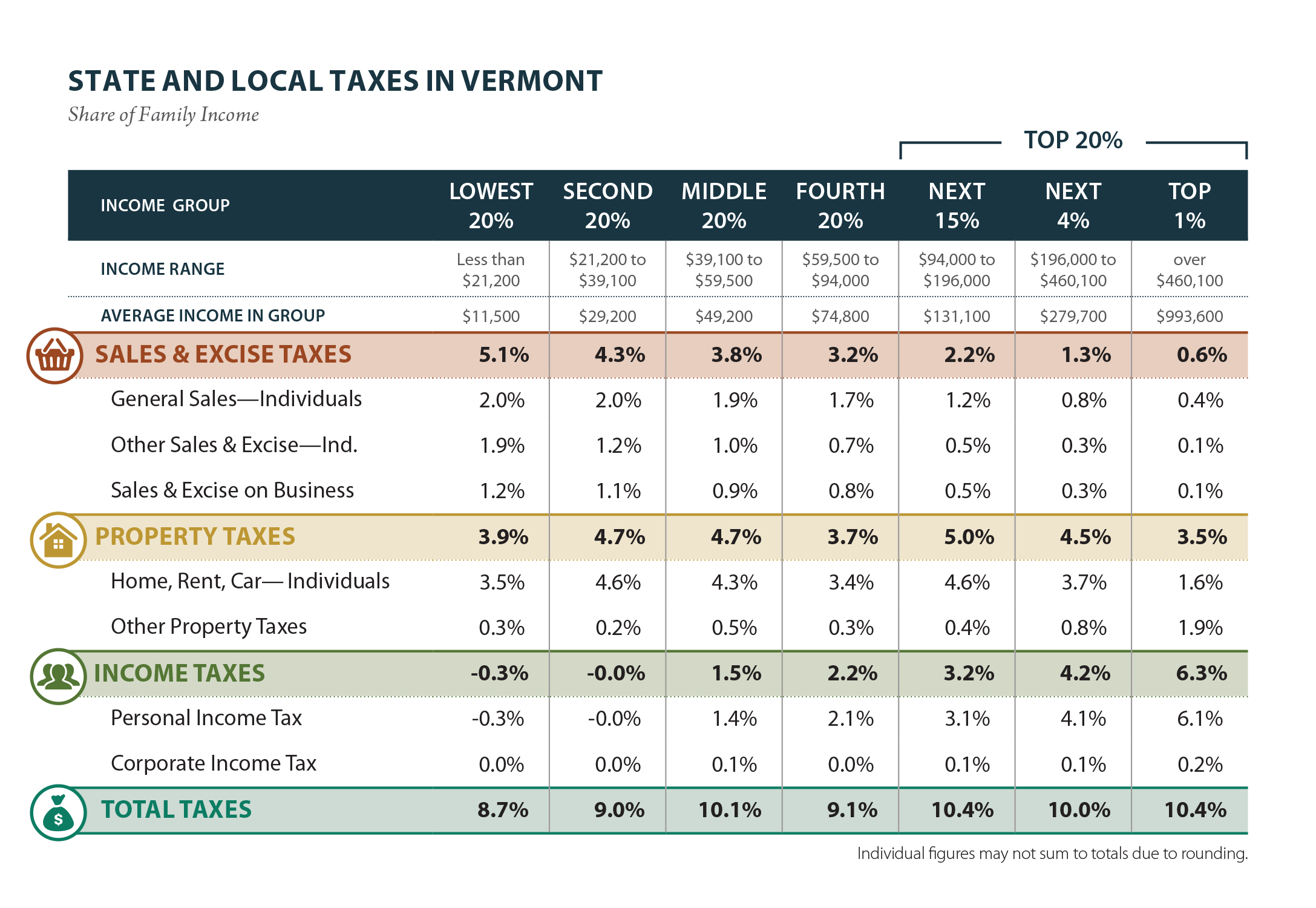

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Income Tax Brackets 2020

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

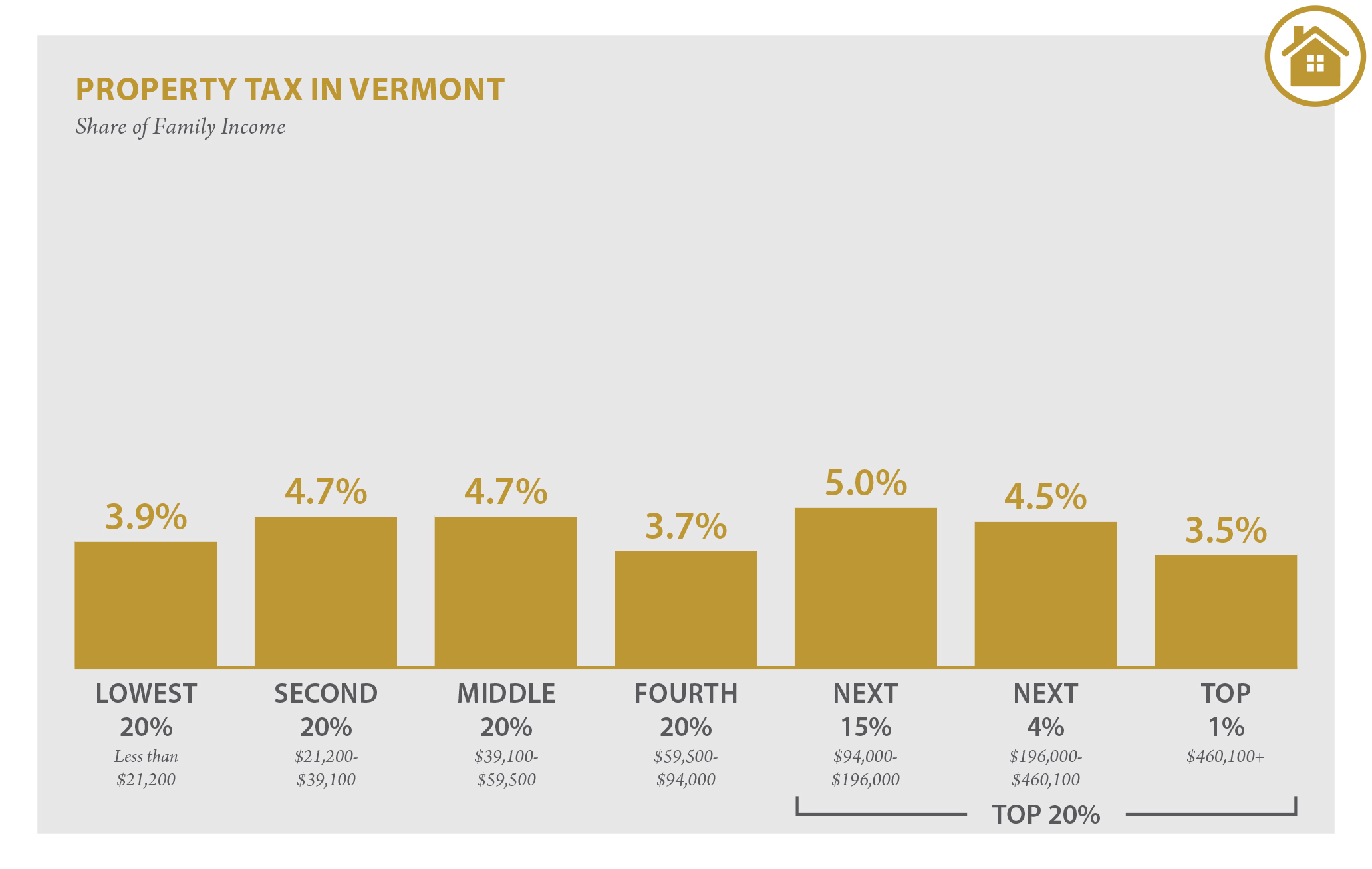

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Historical Vermont Tax Policy Information Ballotpedia

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

The Most And Least Tax Friendly Us States

Effective State Income Tax Map Public Assets Institute

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

File Top Marginal State Income Tax Rate Svg Wikipedia

Vermont Property Tax Rates By Town Lipkinaudette Com